State tax paycheck calculator

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Get Your Quote Today with SurePayroll.

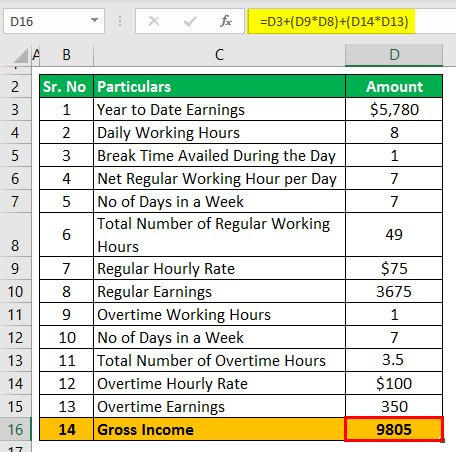

Hourly Paycheck Calculator Step By Step With Examples

Free Payroll Tax Calculators and Tax Rates for Every State Get your paychecks right by quickly calculating your employees payroll taxes withholdings and deductions.

. California Paycheck Calculator - SmartAsset California Paycheck Calculator Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly. Subtract any deductions and. Sign Up Today And Join The Team.

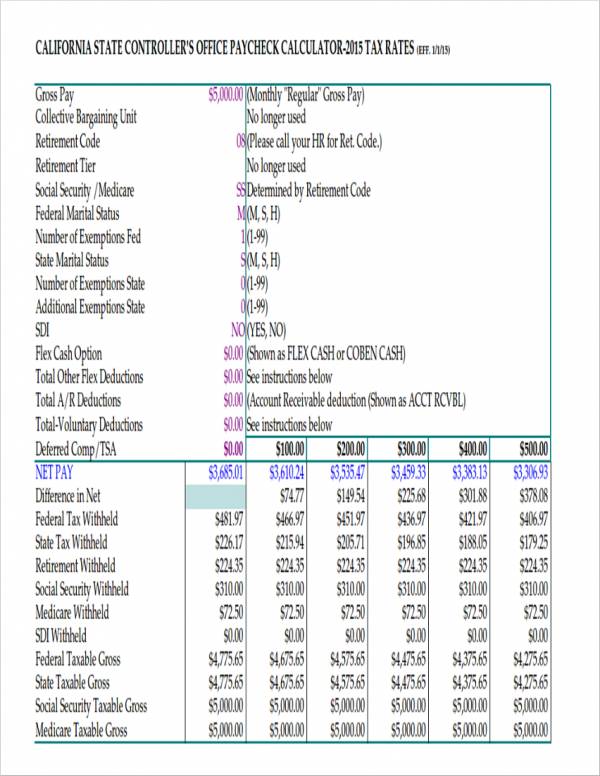

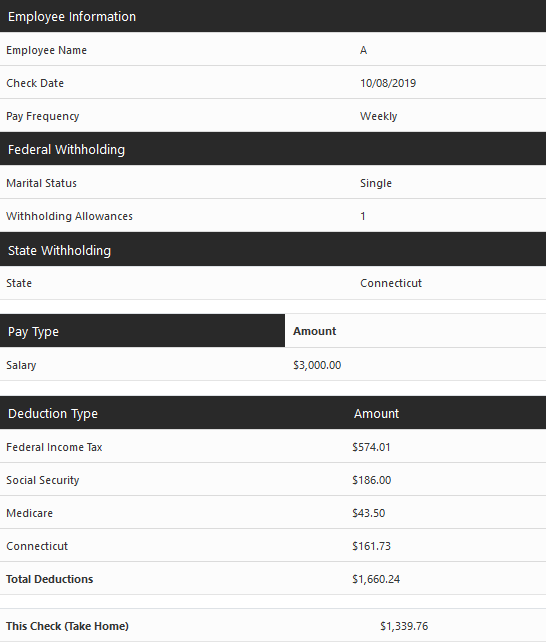

Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. FEDERAL INCOME TAX EXEMPTION STATE INCOME TAX Gross Pay MED ADDITIONAL ALLOWANCES MED SS SS EPMC BASE AMT PERCENT BASE TAX LOW INCOME TAX. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Sign Up Today And Join The Team. Learn About Payroll Tax Systems.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Get Started Today with 2 Months Free. That means that your net pay will be 43041 per year or 3587 per month.

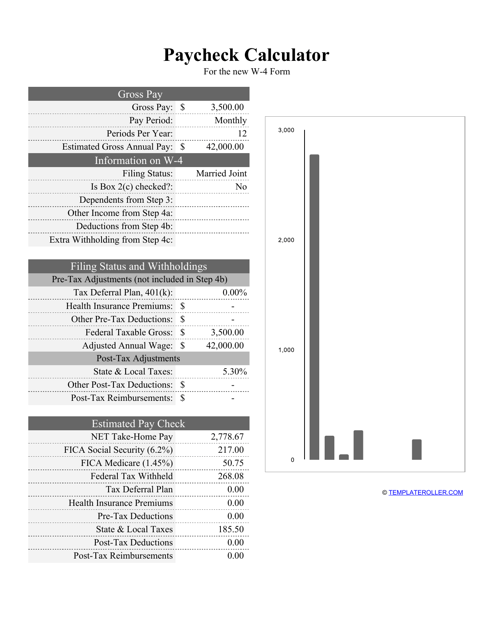

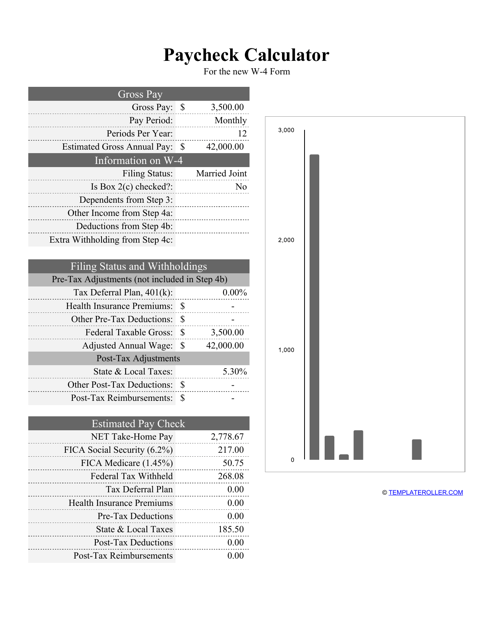

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Find a List of State Tax Calculators and Estimates for Tax Year 2021 and 2022. Estimate Your State and Federal Taxes.

Your average tax rate is. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. First you need to determine your filing status.

Determine if state income tax and other state and local taxes. Over 900000 Businesses Utilize Our Fast Easy Payroll. This number is the gross pay per pay period.

Calculate Federal Insurance Contribution Act taxes using the latest rates for Medicare and Social Security. State Income Tax Withheld. All Services Backed by Tax Guarantee.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Enter your info to see your. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Learn About Payroll Tax Systems. The rates have gone up over time though the rate has been largely unchanged since 1992. California State tax bracket varies from 1 to 133 top tax rate is 133 for income over 1000000 single and 2000000 married filing jointly.

Social Security tax rate. Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds. 17 rows The calculators allow employees to calculate paychecks for monthly semi-monthly.

Federal payroll tax rates for 2022 are. This calculator uses a common. 15 Tax Calculators.

Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software. State Income Tax Calculators.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

New York Paycheck Calculator Smartasset

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

How To Calculate Net Pay Step By Step Example

Paycheck Calculator Online For Per Pay Period Create W 4

Free Paycheck Calculator Hourly Salary Usa Dremployee

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Paycheck Calculator Template Download Printable Pdf Templateroller

Net Pay Definition And How To Calculate Business Terms

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Take Home Pay Calculator

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca